Market Research is an important factor in ensuring a business succeeds. In our society, change is rapid and continuous. The successful business person knows who her potential customers are, and strives to find out everything she can about them.

Market Research is an ongoing process but there are three particularly crucial times when it should be conducted. This document outlines market research steps and how it can help your business.

This document covers:

- What is market research?

- What market research can do for you

- What market research can tell you

- The steps of market research

- State objectives

- Assess the customer and the industry

- Assess the competition

- Secondary research

- Primary research

- Analyze and interpret the date

1. What is Market Research?

Market Research is an important factor in ensuring a business succeeds. In our society, change is rapid and continuous. Inflation, changing lifestyles, unemployment, globalization, technological innovations, and pressures on our environment mean the wants and needs of people – potential customers – are in a constant state of flux. In business, the customer dictates the market. Without customers, there is no reason to produce a product or provide a service.

The successful businessperson knows who her potential customers are and strives to find out everything she can about them. To do this, she must do market research. Market research is an organized, objective collection and analysis of data about your target market, competition, and/or environment with the goal being increased understanding. Through the market research process, you can take data and create useful information to guide your business decisions. Market research is not an activity conducted only once; it is an ongoing study. Market Research is an ongoing process, but there are three crucial times when you should conduct Market Research:

- When starting a new business

- To maintain a business (as information changes continuously)

- When introducing a new product

2. What Market Research Can Do for You

Market research guides your communication with current and potential customers.

Once you have good research, you should be able to formulate more effective and targeted marketing campaigns that speak directly to the people you are trying to reach in a way that interests them. For example, some retail stores ask customers for their zip codes at the point of purchase. This information, which pinpoints where their customers live, will help the store’s managers plan suitable direct mail campaigns.

Market research helps you identify opportunities in the marketplace.

For example, if you are planning to open a retail outlet in a particular geographic location and have discovered that no such retail outlet currently exists, you have identified an opportunity. The opportunity for success increases if the location is in a highly populated area with residents who match your target market characteristics.

The same might be true of a service you plan to offer in a specific geographic area or even globally via the Internet.

Market research minimizes the risk of doing business.

Instead of identifying opportunities, the results of some market research may indicate that you should not pursue a planned course of action. For example, marketing information may indicate that a marketplace is saturated with the type of service you plan to offer. This may cause you to alter your product offering or choose another location.

Market research uncovers and identifies potential problems.

Suppose your new retail outlet is thriving at its location on the main road through town. Through research you learn that in two years, the city is planning a by-pass, or alternate route, to ease traffic congestion through town. You’ve identified a potential problem!

Market research creates benchmarks and helps you track your progress.

It is important to know, for later comparisons, the position of your business at particular moments in time.

Ongoing market research allows you to make comparisons against your benchmark measurements as well as chart your progress between research intervals (such as successive annual surveys). For example, you might establish a benchmark measurement of your target market demographics and learn that 65 percent of your customers are women between the ages of 35 and 50. One year later, you again survey your customers and learn that this age group now represents 75 percent of your customer base. You’re tracking a trend in your customer demographics.

Market research helps you evaluate your success.

Information gathered through market research helps you to determine if you’re reaching your goals. In

the above example, if your product’s target market is a woman between the ages of 35 and 50, then

you’re making progress toward your goal.

3. What Market Research Can Tell You

Market segmentation studies provide information about the characteristics that your customers share. This data provides answers to questions such as: Who are my customers? What is the size of their population? What percentage is female? What are their ages, income and education levels? What are their occupations, skills, interests and hobbies? How many children do they have? Do they have pets? Where do they live and work?

Purchasing power and buying habits information uncovers the financial strength and economic attributes shared by your target market. Some questions to be answered include: What is the average dollar amount spent on purchases of products or services similar to mine? What are the financing needs of my target market? What is their current usage of my services? When do they purchase? Where do they shop? Why do they decide to buy?

Psychological aspects of the market is information regarding the perceived opinions and values held and shared by consumers in your market. Questions to be answered: What is the reaction of the market to my programs or services? How does the market compare my company to other businesses? What qualities and characteristics do my customers deem important? What are the deciding factors in making a purchase? Are they looking for convenience and time—saving devices? What confuses my customers and prospects?

Marketplace competition is information about the other companies within your area of business. Research answers these questions: Who are my primary competitors in the market? How do they compete with me? In what ways do they not compete with me? What are their strengths and weaknesses? What is their market niche? What makes my business unique? What is their sales volume? Where are they located?

Environmental factors information uncovers economic and political circumstances that can influence your productivity and operations. Questions to be answered include: What are the current and future population trends? What are the current and future socio-economic trends? What effects do economic and political policies have on your target market or my industry? What are the growth expectations for my market? What outside factors influence the industry’s performance? What are the trends for this market and for the economy? Is the industry growing, at a plateau, or declining?

4. The Steps of Market Research

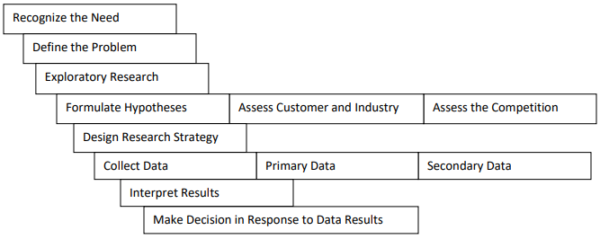

Market Research includes the following steps, which are covered in detail:

5. State Objectives

What are the big questions you need answered? The best way to determine these questions is to brainstorm. Gather a group of creative, open-minded, practical, original people and allow them to generate as many ideas and questions as possible about the potential product/service. As part of your objectives, determine the time frame you need to conduct your market research and the amount of money you have available for market research.

The following questions become your objectives for research. These questions focus on the customer, the competition, and the industry. The questions are quite general at this point and will become more specific as you proceed through the research process.

- Who is the customer? (age, habits, occupation, lifestyle, etc.)

- Are there enough customers now and in the future?

- What are the needs of these customers?

- What are they willing/able to pay for this product/service?

- Is there a profit margin?

- How are the customer’s needs changing?

- How is the industry changing?

- What is the fastest—growing segment of the industry?

- Who is the competition?

- Can I offer something the competition cannot?

- What is the future of the product? Trends? Lifecycles?

There are two sources of data for Market Research, each equally important:

- Primary Research Data – data you generate yourself by conducting a survey questionnaire (mail in person, telephone, product sampling or through focus groups)

- Secondary Research Data – information and statistics that already exist.

There are two kinds of data:

- Quantitative Data – data that can be expressed as quantities, percentages, or numbers. It can be easily compiled into lists and graphs. Demographics are an example of quantitative data. Demographics are the statistical characteristics of the population (age, gender, education, race, occupation, memberships, income, religion.)

- Qualitative Data – information about people’s feelings and needs that cannot be expressed in

numbers. It provides insight into people’s behavior and characteristics. Psychographics is an

example of qualitative data. (Psychographics are information about how people behave, feel,

think and perceive.)

There are two factors that can affect this data:

- Trends – Trends occur because of world events such as shifts in economies, demographic changes, technological changes, war, and climate changes. In North America, the population is aging and stabilizing. Business implications of this trend might be a need for smaller dwellings and increased medical care. Another trend is the knowledge explosion. Information is readily accessible to us via fax, email, the internet, and other technological advancements. Business implications may include growth in non-fiction publications and a need for new ways of searching for information and services for people who have difficulty accepting and responding to change. By studying trends, you will be able to anticipate needs and develop a clear vision of the future which may help you anticipate successful products and services.

- Product Life Cycle – The life cycle of a product is made up of introduction, growth, maturity and decline phases. Products in different stages of the product life cycle have different marketing needs in order to continue to be viable. The introduction stage necessitates stimulating demand for the new product by providing information about its features. The growth phase eventually reaps the benefit of a successful earlier promotional campaign. In the maturity stage, sales continue to grow but eventually reach a plateau as the customers settle into a regular buying pattern. The decline stage is when shifting consumer preferences or new innovations cause an absolute decline in total industry sales.

6. Assess the Customer and the Industry

Once you have formulated your questions (objectives), and have created a time frame, a budget estimate, and an understanding of some basic market research jargon, you are ready to search for data to answer your questions. You have to start somewhere, so start with your common sense. Using what you have observed and what you already know, you will assess the customer and the industry.

Make a table like the example below as an informal, preliminary type of assessment of the customer and the industry. Remember that the information that you gather for this table will be general. From these generalizations, you need to apply ‘segmentation’ (divide the general information into segments in order to tailor your product, service, pricing, and strategy.) For example, in the demographics section for Fast Food, you can make 3 segments from the large age range: 10-20 years, 20-35 years, 35-50 years. With these segments you are now able to focus on tailoring your service or product.

Customer Profile

| Product | Demographics | Geographics | Psychographics |

| Fast Food | 10-50 years old, all income levels | Urban | Practical, budget minded, active lifestyle |

| Privately owned family restaurant | Middle income, family oriented, retired | Rural/Urban | Health conscious, home-style tastes, quality conscious |

| Trendy, upscale restaurant | 18-35 year old, middle to upper income, singles and couples | Urban | Busy social life, professional, status seeker, upwardly mobile |

Industry Profile

| Product/ Business Type | Supply/ Demand | Advertising/ Promotional Strategies | Customer Service Standards | Suppliers | Regulations | Price |

| Fast food | High/High | Cleanliness, quick service, media, flyers, coupons, consistent product | Fun, fast, clean, less expensive | Franchise, local markets | Health, fire, safety | $5.00/ meal |

| Privately owned family restaurant | Limited/ Moderate | Home-style cooking, family oriented, good meal for good price, good service Word of mouth | Good friendly service | Costco, local food stores, bulk stores | Health, fire safety | $9.00/ meal |

| Trendy, upscale restaurant | Moderate To high/ Moderate to high | Trend setters, Exciting atmosphere Media, flyers, coupons | Good, friendly service with a thematic setting | Franchise, local markets | Health, fire, safety | $15.00/ meal |

From the questions you have gathered in your objectives and the assessment of customer and the industry you can make an early assumption of hypothesis as to who your customers are. You will test this assumption by further research – Primary and Secondary. The research will prove or disprove your assumption.

7. Assess the Competition

Look for strategies used by the competition, as well as trends and patterns the industry has seen

- Observation – street side evaluation is an excellent method by which to assess the competition. Using a checklist you can readily record your observations: prices, how busy they are, length of customer wait, strategies used for promotion and so forth.

- Become a customer

- Ask suppliers

- Attend trade shows

- Telephone book

- Internet

- Phone the competition and ask for information, be honest or phone a company in another town so that no one feels threatened.

Competition Profile

| Production | Pricing | Business Location | Years in Service | Strengths | Weaknesses | Reputation |

| McDonalds | $5.00 | Same | Inexpensive | Unskilled labor, high turnover | Good customer service | |

| Smitty’s | $9.00 | Urban only | Good quality food | Predictable | Reliable | |

| Red Robins | $15.00 | Same | Trendy, change with the times | Noisy | Fun |

8. Secondary Research

Collect data that already exists. This data will provide an overview of the industry and identify gaps in your research that can then be filled by primary research. Here again, you are looking for trends, product/service lifecycles, changes, and strategies. Generally, you are staying in touch with the industry. There are two types of secondary data: internal and external. Internal data include records of sales, product performance, sales-force activities, and marketing costs. External data is obtained from a variety of sources as listed below:

- Government agencies

- Industry Canada

- Stats Canada Chamber of Commerce

- BC Stats

- Economic Development Commission

- Libraries

- Banks’ Analysis Reports (TD)

- Universities, Community Colleges

- Patents, trademarks, copyrights

Remember you are aiming to answer the questions you stated as your objectives. Stick to finding

answers to these questions otherwise, the amount of information will become overwhelming. For

example: If I am researching the need for a safe house/counselling service for seniors who suffer abuse,

I do not need a lot of data indicating there is a high level of senior abuse. More than that, I need data

showing whether or not there are enough safe house/counselling services in the specific area that I am

looking to set up in. That is why primary research is done.

9. Primary Research

This involves generating data in order to find answers to the questions that have not been answered through the Secondary Research.

Developing the Questionnaire / Survey

You may choose to conduct your survey research by mail, in person, or by telephone. Which method you

choose depends on the time and funds available and the type of information you are seeking. But

always keep in mind the following guidelines for Questionnaire Development.

- Always test a survey before it goes to the public.

- Survey should be short: preferably one page, 15 questions or less.

- Make it interesting. Try to arouse interest and to motivate the respondent to answer.

- Keep the flow of the questions logical and group questions that are of the same topic.

- Always include an introduction.

- You fill in the survey for the person for an in-person survey.

- Set the stage. Be sure the setting is not rushed, noisy, or a completely non-business atmosphere. You need to evoke an honest, positive feeling.

- The greater number of people surveyed gives the less chance of error.

| Number of samples | Chance of Error |

| 100 | 10% |

| 300 | 6% |

| 500 | 5% |

| 1,000 | 3% |

- There are generally three parts of a survey: Current Product Use, Customer Response to the Product, About Yourself.

- Be careful not to use leading questions. The respondent should not be able to discern what type of answer the surveyor wants to hear. E.g. “Now that you’ve seen how you can save time, would you buy our product?”

- Be careful not to bias your survey. If your target group contains people of various ages, you must be sure to include a representative number of these age groups in your survey.

- Be sure the questions are clear and unambiguous. Start with general questions and move towards specific questions, putting the most difficult ones in the middle of the questionnaire.

- There are four types of questions you can use on a survey. Be sure to use some of each.

- Two choices: the respondent has an either/or selection. Generally, this question type does not give enough useful information.

- Multiple choice: the respondent chooses one or more possibilities from a list

- Ranking: the respondent uses a scale to evaluate a single item. Always give an even number of choices. This forces them to take a stand and not just put the average/good answer.

- Open-ended: the respondent gives detailed, qualitative answers.

Sources of:

| Primary Information | Secondary Information |

| – Questionnaires – Talking to Customers – Interviews – Conducting focus groups – Talking to competitors – Assessing/evaluating competitors – Talking to suppliers, distributors, retailers, agents, brokers – Talking to consultants, advisors, mentors – Hiring students to complete a survey for you | – Printed Material: o Census Reports (Stats Canada) o Trade magazines and journals o Libraries and resource centers o Books on the industry o Published reports and studies – Contact: o Industry and trade associations o Chambers of Com |

10. Analyze and Interpret the Data

You now need to tally the responses. You can do this by hand or by using a computer (spreadsheet or word processor) depending on how much data you have to analyze. Then you must chart or graph the responses. This makes it easier for you and others (bankers, investors, managers, etc.) to read and interpret. The next step is to determine the meaning of the responses. You will be looking for five factors: trends, similarities, life cycles, contradictions, and odd groupings (i.e. too many similarities). The first three indicate that you are on the right track with your product idea, the second two are warnings indicating you may have to rethink your product.

For qualitative data, read over all information gathered from surveys (open-ended questions), focus groups, and product sampling. You are still looking for the same five factors: trends, similarities, life cycles, contradictions, and odd groupings. The qualitative data is particularly useful for psychographical purposes. Finally, from the analysis and interpretation of your data, if it is accurate, you will be able to determine sales and projections.

Once you have interpreted the data from your research, go back and check your hypothesis (section 5). At this point, your assumption may need to be adjusted, or it may be there is not a definite need for your product/service, and you must start again, or you are ready to move on to creating a business plan. Whatever the results, after doing Market Research you will have a thorough assessment of the market and the customer and should be able to answer the following questions: Is the industry growing or shrinking? What is the growth rate of the product/service? What are the common patterns of this industry? What are the strengths and weaknesses of the competition? What are the demographics of the customer? Are there enough customers for this product/service?

11. Resources for Market Research

Industry Canada: www.strategis.ic.gc.ca

Small Business BC: www.smallbusinessbc.ca | 1-800-667-2272

BC Stats: www.bcstats.gov.bc.ca | 1-800-663-7867

Business Development Bank of Canada: www.bdc.ca | 1-800-232-2269

Labour Market Information: www.labourmarketinformation.ca | Check the website for a location/phone number near you

Western Economic Diversification: www.wd.gc.ca | 1-888-338-9378

Human Resources and Skills Development Canada: www.hrsdc.gc.ca | 1-800-622-6232

Canada Business Network: http://www.canadabusiness.ca/eng/page/2864/

Community Futures Development Corporation: www.communityfutures.ca | Check your local listings for a phone number

WeBC: www.we-bc.ca | 1-800-643-7014